How to Use Medicare Extra Help for Generic Prescriptions in 2025

Dec, 2 2025

Dec, 2 2025

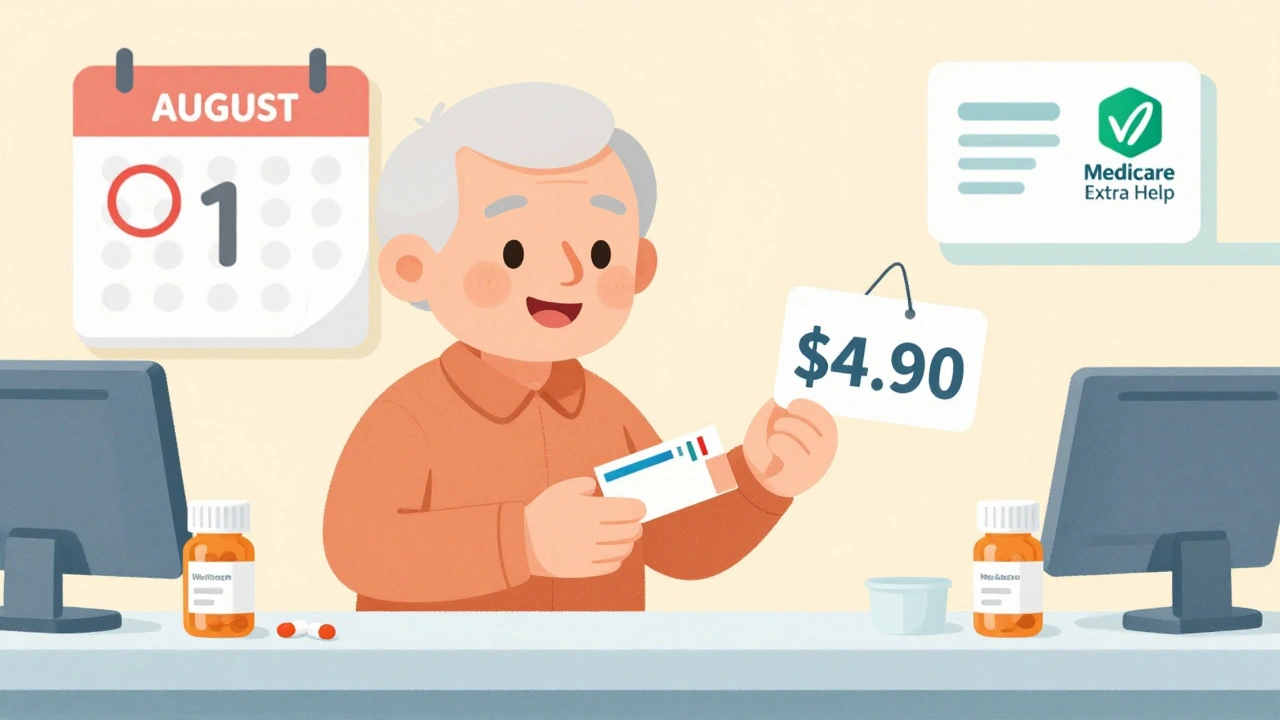

If you’re on Medicare and taking generic medications, Medicare Extra Help could cut your drug costs by thousands each year. For many seniors, this program turns unaffordable prescriptions into $4.90 co-pays - and sometimes even less. But most people don’t know they qualify, or they give up after filling out the confusing application. Here’s exactly how it works in 2025, what you pay, who qualifies, and how to avoid the common mistakes that cost people their benefits.

What Medicare Extra Help Actually Covers

Medicare Extra Help, officially called the Part D Low-Income Subsidy (LIS), is a federal program that pays for the parts of your prescription drug plan you can’t afford. It doesn’t just lower your co-pays - it wipes out your monthly premium and yearly deductible completely. For generic drugs, you pay no more than $4.90 per prescription at any participating pharmacy. If you’re also on Medicaid and your income is below 100% of the Federal Poverty Level, you pay just $1.60 per generic.

Compare that to standard Medicare Part D. Without Extra Help, you’d first have to pay up to $595 out of pocket just to start getting coverage. Then, you’d pay 25% of the drug’s cost. A $50 generic would cost you $12.50 after the deductible. Multiply that by 12 prescriptions a month, and you’re looking at over $700 a year just in co-pays - not counting the $595 deductible or your $30-$50 monthly premium.

Extra Help removes all that. No deductible. No premium. Just $4.90 - or less - for every generic. That’s the difference between skipping pills because you can’t afford them and taking them as prescribed.

Who Qualifies in 2025

To get Extra Help, your income and resources must be below strict limits. These aren’t suggestions - they’re hard cutoffs. For 2025:

- Income limit: $23,475 per year for one person, $31,725 for a married couple living together.

- Resource limit: $17,600 for one person, $35,130 for a couple.

Income includes Social Security, pensions, wages, and veterans’ benefits. It does NOT include housing assistance, food stamps, or medical care payments.

Resources are things you own that can be turned into cash: bank accounts, stocks, bonds, mutual funds, IRAs, and second homes or land. Your primary home, one car, personal belongings, and life insurance policies don’t count. You also get a $1,500 exemption for burial expenses.

Many people think they don’t qualify because they own a home or have a small savings account. But if your only assets are your house, a car, and $10,000 in a savings account, you likely still qualify. The rules are tighter than people expect - but also more forgiving in some ways than they seem.

How to Apply - Step by Step

You don’t need a lawyer or a financial advisor. The application is free, and help is available everywhere. Here’s how to do it:

- Check if you’re automatically enrolled. If you get Medicaid, Supplemental Security Income (SSI), or a Medicare Savings Program, you’re already signed up. No action needed.

- If you’re not automatic, apply online. Go to ssa.gov/extrahelp. The form takes about 20 minutes. You’ll need your Social Security number, details about your income and resources, and your Medicare card.

- Call if you can’t apply online. Dial 1-800-772-1213. Representatives can walk you through the form over the phone.

- Visit your local Social Security office. Bring your documents. No appointment needed.

- Get free help from SHIP. Every state has a State Health Insurance Assistance Program. They’re trained to help with Extra Help applications. Find yours at shiptacenter.org.

Processing takes 3 to 6 weeks. You’ll get a letter in the mail confirming your approval or denial. If you’re approved, your new co-pays start immediately - even if you’re still waiting for the letter.

What Happens Every Year

Extra Help isn’t a one-time thing. You have to reapply every year - but not from scratch. Each August, you’ll get a form in the mail called the “Annual Review.” It’s pre-filled with your information. All you do is check it, sign it, and return it.

Here’s the catch: you have 30 days to return it. If you miss the deadline, your Extra Help ends on January 1 of the next year. No warning. No grace period. Just gone.

Some people get a letter saying their benefits are ending because their income went up by $500. That’s not a mistake. The program doesn’t allow for small increases. If you’re just over the limit, you lose everything - even if you’re still struggling to pay for meds.

That’s called the “cliff effect.” And it’s why so many seniors lose coverage. One year, they’re paying $4.90. The next, they’re paying $1,200 a year in premiums and co-pays. One small raise from Social Security - and their prescriptions become unaffordable.

Real Stories: What Happens When People Get It - and When They Lose It

One man in Ohio, 78, takes six generic drugs for diabetes, high blood pressure, and cholesterol. Before Extra Help, he spent $320 a month just on co-pays. He skipped doses. His doctor noticed his numbers were worsening. After applying, his co-pays dropped to $4.90 each. His blood pressure stabilized. He said, “I didn’t realize I was slowly killing myself by saving $30 a month.”

A woman in Florida, 82, got Extra Help in 2023. Her income was $22,000. In 2024, her Social Security increased by $120 a month - just $1,440 a year. Her new income was $23,440. She was $35 over the limit. She lost Extra Help. Her monthly drug cost jumped from $29 to $185. She had to choose between her meds and her heating bill. She called the Medicare helpline. They told her there was no appeal. “I’m not rich,” she said. “I just got a little more money. That’s not a reason to take away my health.”

These aren’t rare cases. In 2024, over 37% of eligible seniors didn’t enroll. Another 1 in 5 lost benefits because they missed the annual review. Most didn’t know the deadline existed.

What You Can’t Do With Extra Help

Extra Help doesn’t cover everything. You still need a Medicare Part D plan. It doesn’t pay for non-covered drugs. You still have to use pharmacies in your plan’s network. Some plans have preferred pharmacies where your co-pay is even lower.

You also can’t use Extra Help to get brand-name drugs cheaper unless you have a medical exception. But if your doctor says a brand-name drug is medically necessary, you can request a formulary exception - and Extra Help recipients get faster approval.

And while Extra Help removes the coverage gap (the “donut hole”), you still have to pay your $4.90 co-pay even during that phase. The program just makes sure you never hit a wall where you owe thousands.

What’s Changing in 2025 and Beyond

This year, the $35 monthly cap on insulin became law for all Medicare Part D users - including those with Extra Help. That means even if you’re not eligible for Extra Help, insulin costs are now capped. But for those who are eligible, it’s just another layer of savings.

There’s also talk of expanding eligibility. The Biden administration proposed raising the income limit to 175% of the Federal Poverty Level - that’s about $28,500 for one person. If that passes, over a million more seniors could qualify. Right now, the program helps 15.2 million people. That number could grow to 18 million by 2027.

But until then, the rules stay the same. The income limits are tight. The deadlines are strict. And the savings are huge.

What to Do Next

If you take any generic drugs and your income is under $23,475 (or $31,725 if married), apply now. Don’t wait. Don’t assume you don’t qualify. Even if you think you’re just above the limit, call your local SHIP. They’ve seen cases where people were approved after a simple review of their assets.

If you already have Extra Help, mark your calendar: August 1. That’s when the renewal form comes. Set a reminder. Return it within 30 days. Don’t wait. Don’t ignore it. Losing this benefit can be devastating.

If you’re helping a parent or relative, sit with them during the application. The form is confusing. The terms are technical. But the reward - $5,900 or more in annual savings - is worth the 20 minutes it takes.

Medicare Extra Help isn’t a luxury. For millions of seniors, it’s the difference between staying healthy and falling through the cracks. If you qualify, don’t let bureaucracy steal your medicine.

Can I get Extra Help if I have savings in the bank?

Yes, as long as your total countable resources are under $17,600 for an individual or $35,130 for a couple. Your primary home, one car, and personal items don’t count. Cash in checking or savings accounts, stocks, and IRAs do count. If you have $15,000 in savings and nothing else, you likely qualify.

Do I need to reapply every year?

Yes. Every August, you’ll get a form in the mail to confirm your income and resources for the next year. You must return it within 30 days. If you don’t, your Extra Help ends on January 1. You won’t get a warning. Don’t ignore this letter.

What if my income goes up a little? Do I lose everything?

Yes. The program has strict income limits with no grace period. Even $50 over the limit can cause you to lose all benefits. This is called the “cliff effect.” Some people lose coverage because their Social Security check increased by a few dollars. There’s no appeal process for small overages.

Can I change my Part D plan if I have Extra Help?

Yes. Extra Help gives you a Special Enrollment Period. You can switch your Part D plan once a month, and the change takes effect the first of the next month. This lets you find a plan with lower co-pays or better coverage for your specific drugs.

Are brand-name drugs covered under Extra Help?

Yes, but at a higher co-pay: $12.15 per prescription in 2025. Generic drugs are capped at $4.90. If your doctor says a brand-name drug is medically necessary, you can request a formulary exception - and Extra Help recipients get priority review.

Sandridge Nelia

December 4, 2025 AT 11:16I applied for Extra Help last year after my husband passed - took me three tries because I didn’t realize my IRA counted as a resource. Once I figured it out, I saved over $5,200 in 12 months. My insulin’s $35, my blood pressure med’s $4.90, and I don’t skip doses anymore. Don’t overthink it. Just apply.

And yes, your house doesn’t count. Your car doesn’t count. Your $12k in savings? Still probably qualifies you. I had $14k and got approved. 🙌

Mark Gallagher

December 6, 2025 AT 06:51You people are being manipulated. This program is a socialist handout disguised as ‘help.’ The government wants you dependent. Why not work longer? Why not save? If you can’t afford meds, you made bad life choices. This isn’t a right - it’s a welfare trap. And don’t get me started on the ‘cliff effect’ - that’s life. No safety nets in real America.

Also, ‘$4.90’? That’s a marketing lie. They still charge you for the drug - the government just pays the rest. You’re not saving money. You’re just being subsidized. Wake up.

Wendy Chiridza

December 7, 2025 AT 01:00Mark, you’re missing the point. This isn’t about politics - it’s about people who took care of their health, paid taxes, worked their whole lives, and now can’t afford the pills that keep them alive. I’ve seen my mom choose between insulin and groceries. That’s not a life choice. That’s a system failure.

And yes, the cliff effect is real. My neighbor got a $100 raise and lost everything. No warning. No appeal. Just gone. The system should have a buffer zone. It doesn’t. That’s the problem. Not the program. The rules.

Pamela Mae Ibabao

December 8, 2025 AT 12:13OMG I LOVE THIS POST. Like seriously. I work at a pharmacy and I see this every day. People crying because their $185 med just jumped from $4.90. One woman asked me if she could ‘sell her TV’ to pay for her diabetes pills. I had to tell her no - because she already sold it last year. She’s on oxygen now. This isn’t hypothetical. It’s happening in real time.

And the annual renewal? I’ve seen 17 people lose it because they missed the mail. One guy didn’t even know he had Extra Help until he got the termination letter. He was 81. He thought it was automatic. It’s not. It’s a trap. Please, please, please - set a calendar reminder. August 1. Write it on your fridge.

Palanivelu Sivanathan

December 9, 2025 AT 16:48...and yet... in the grand cosmic dance of bureaucracy, we are but dust... the $4.90 co-pay is a mirage in the desert of American healthcare... the government gives with one hand and takes with ten... the cliff effect? It’s not a flaw - it’s a feature. A feature designed to make you suffer just enough to keep you humble...

But still... I applied. Because even in this broken system, I refuse to die because I forgot to mail a form. I cried reading this. Not because I’m weak. Because I’m alive. And I want to stay that way. 🌅

Jessica Ainscough

December 11, 2025 AT 06:31Just wanted to say - if you’re reading this and thinking ‘I don’t qualify’ - call SHIP. Seriously. I helped my aunt apply last year. She thought her $18k savings disqualified her. The counselor found three things that didn’t count and got her approved. Took 15 minutes on the phone. Free. No paperwork. No stress.

You don’t have to be perfect. You just have to try. And if you’re helping someone older? Sit with them. Read the form out loud. They’ll thank you later.

Kevin Estrada

December 12, 2025 AT 00:09LMAO the ‘cliff effect’ is just capitalism doing its job. If you can’t afford meds, maybe don’t live in Florida and buy 3 cars and a timeshare? I’ve got a cousin on SSDI who pays $2 for his meds and still has a $300k house. He didn’t apply for Extra Help because he ‘didn’t want to look poor.’

Also - why are you all acting like this is a miracle? It’s a program. Programs have rules. Life has rules. Stop whining. If you want free stuff, move to Canada. Or just get a job. 😎

Katey Korzenietz

December 13, 2025 AT 11:05My uncle lost Extra Help because his Social Security went up $47. He’s on oxygen now. He can’t afford his nebulizer meds. The government sent him a letter in tiny font on yellow paper. He didn’t read it. He thought it was junk mail. He died in January. This isn’t about money. It’s about dignity. And they took it from him because he was too tired to read a letter. 💔

Michael Bene

December 13, 2025 AT 17:38Okay so here’s the thing - I’m Canadian and I’m honestly baffled. You guys have a program that cuts drug costs to $4.90 for generics? And you’re still fighting over whether it’s ‘socialist’? In Canada, insulin is free. Like, literally free. No forms. No cliffs. No ‘annual reviews.’ You walk in, you get it. Done.

But here? You need a PhD in bureaucracy to get $4.90 pills. And people die because they missed a deadline? That’s not a system. That’s a horror story dressed in paperwork. I’m not even mad. I’m just… sad. And weirdly proud of my country right now.

Brian Perry

December 15, 2025 AT 03:04So I got approved last year. Then I got a letter in July saying my benefits were ending because my bank balance was $17,650. I had $50 over. I called. They said ‘no exceptions.’ I cried. Then I sold my grandfather’s watch - the only thing I had left from him - to pay for my meds for 3 months. I didn’t tell anyone. I didn’t want pity.

Now I’m applying again. This time I’m putting everything in my daughter’s name. I know it’s shady. But I’m not dying because I had $50 too much in savings.

Chris Jahmil Ignacio

December 15, 2025 AT 20:41This is all part of the Great Medicare Deception. The government wants you dependent. They know if you’re on Extra Help, you’ll never vote Republican. They’ve been pushing this since 2006. The ‘$4.90’ is a trap. They want you to think you’re getting help - but it’s just a leash. And the annual review? That’s how they track you. They know exactly how much you make. They know your bank balance. They know your meds. This isn’t help. It’s surveillance with a discount.

And don’t tell me about SHIP. They’re just government puppets. I’ve seen their training manuals. They’re trained to say ‘apply’ - not to question the system. The system is rigged. Don’t play their game.

Paul Corcoran

December 16, 2025 AT 06:24Look - I’m not perfect. I’ve been on Medicare for 8 years. I didn’t apply for Extra Help until my third heart attack. I thought I made too much. I was wrong. I applied. Got approved. Saved $6,000. My wife said I was being selfish - ‘you’re not poor.’ But I was sick. And I couldn’t afford my blood thinner.

So here’s what I say to everyone: if you’re taking any prescription - even one - and you’re over 65, APPLY. Don’t overthink it. Don’t wait for someone to tell you you’re ‘worthy.’ You are. You’ve paid into this system. You deserve to live.

And if you’re helping someone else? Do it with love. Not judgment. Not politics. Just love. Because tomorrow, it might be you.