How Generic Medicines Save Trillions in U.S. Healthcare Costs

Dec, 4 2025

Dec, 4 2025

For every $100 spent on prescription drugs in the U.S., just $12 goes to generic medicines - yet those same generics make up 90% of all prescriptions filled. That’s not a mistake. It’s the single biggest reason the American healthcare system hasn’t collapsed under the weight of rising drug prices.

In 2024 alone, generic and biosimilar drugs saved the U.S. healthcare system $467 billion. That’s not a rounding error. That’s more than the entire annual budget of the Department of Education. Over the last decade, those savings have added up to $3.4 trillion. If you took every dollar saved from generics and turned it into $100 bills, you’d have a stack taller than Mount Everest.

How did this happen? It started with a law no one talks about: the Hatch-Waxman Act of 1984. Before that, if a brand-name drug’s patent expired, the manufacturer could still block competitors by making tiny changes to the formula - or just sitting on the patent for years. Hatch-Waxman changed that. It created a clear path for generic drug makers to prove their versions worked just as well, without repeating expensive clinical trials. The result? Competition. And when competition enters the drug market, prices drop - fast.

How Generics Cut Costs Without Cutting Corners

People often worry that generics are inferior. They’re not. The FDA requires them to have the same active ingredients, strength, dosage form, and route of administration as the brand-name version. They must also be bioequivalent - meaning they get into your bloodstream at the same rate and to the same extent. The only differences? Color, shape, and inactive ingredients like fillers or dyes. Those don’t affect how the drug works.

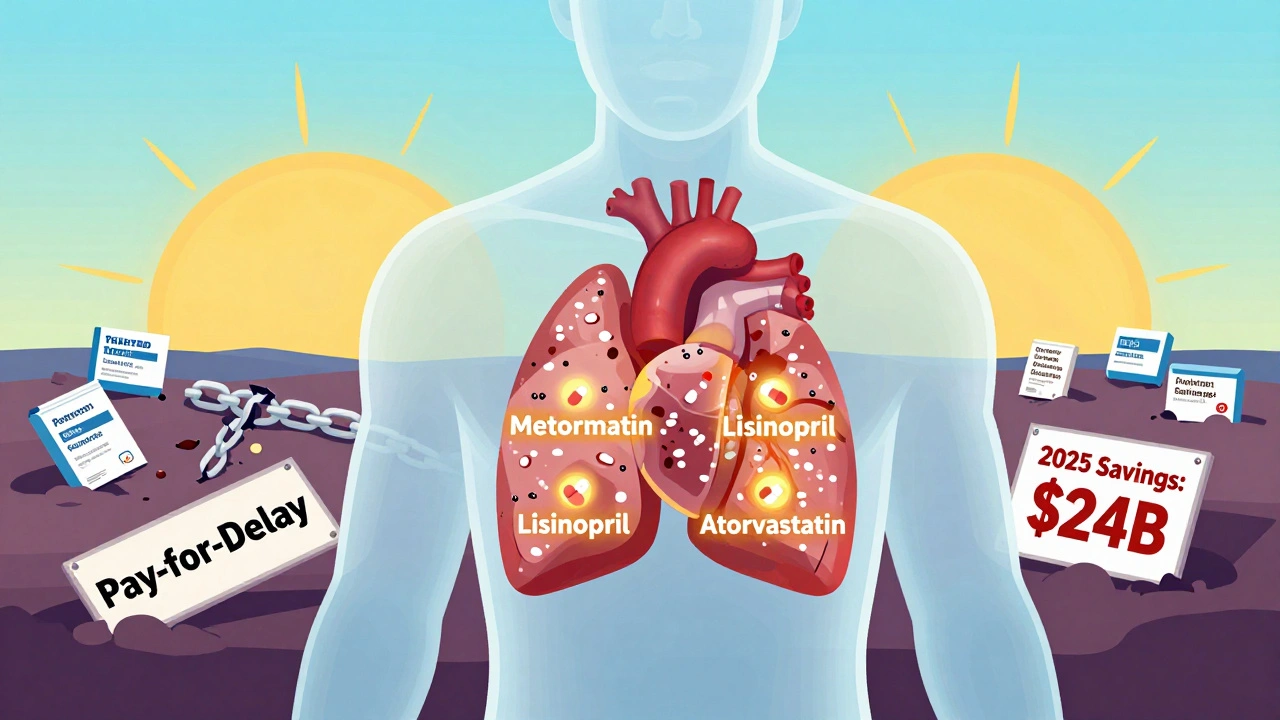

Take metformin, the most prescribed generic drug in America for type 2 diabetes. The brand version, Glucophage, cost over $200 a month before generics hit the market. Today, a 30-day supply of metformin costs less than $4 at Walmart. That’s not a sale. That’s the power of competition. In 2023, the top 10 generic drugs saved patients and insurers $127 billion combined. The top 10 most commonly prescribed generics - like lisinopril for high blood pressure and atorvastatin for cholesterol - saved another $89.5 billion.

And it’s not just pills. Biosimilars - generic versions of complex biologic drugs like Humira and Enbrel - are now saving billions too. In 2024, biosimilars saved $20.2 billion in one year. Since the first biosimilar entered the market in 2015, that number has climbed to $56.2 billion. These drugs treat cancer, autoimmune diseases, and other serious conditions. Without biosimilars, many patients would never be able to afford treatment.

Who’s Really Paying the Bill - And Who’s Saving

It’s easy to think of drug costs as something only patients pay. But the real burden falls on insurers, Medicare, Medicaid, and taxpayers. In 2024, generics saved Medicare $142 billion and Medicaid $62.1 billion. That’s money that didn’t have to come out of federal budgets. That’s fewer tax dollars spent on drugs that could’ve gone to schools, roads, or nursing home care.

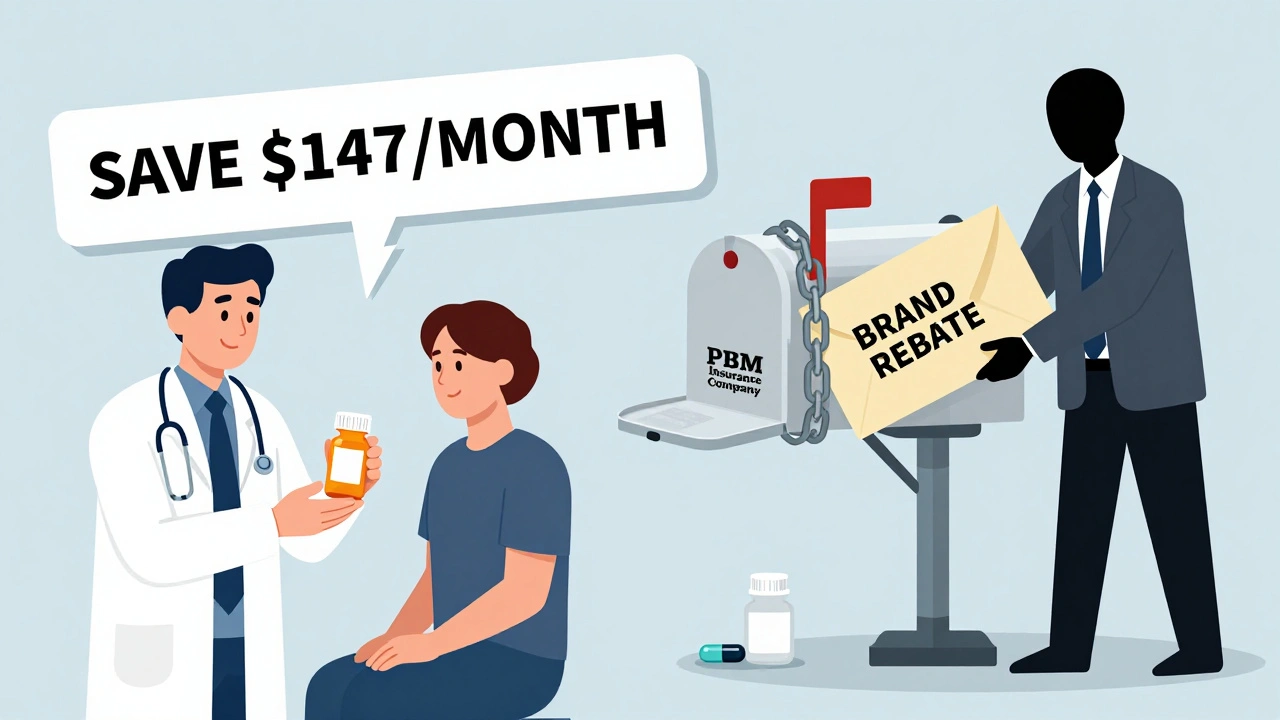

Private insurers aren’t doing charity. They use generics because it cuts their costs - and they pass some of those savings to consumers. A 2023 survey of 500 patients found that 89% who switched from brand to generic drugs reported being satisfied with both cost and effectiveness. The average monthly savings per medication? $147. For someone taking three generics a month, that’s over $5,000 a year.

But here’s the catch: not everyone gets that discount. Some Medicare Part D plans still push patients toward expensive brand-name drugs, even when cheaper generics are available. Pharmacy Benefit Managers (PBMs), who negotiate drug prices on behalf of insurers, sometimes get paid more to promote brand drugs. That’s not a typo. Some PBMs earn rebates from manufacturers based on how many brand-name drugs they sell - even if a cheaper generic exists. That’s why, despite generics being used in 90% of prescriptions, patients still see high out-of-pocket costs.

Why Savings Aren’t Bigger - And Who’s Stopping Them

The system works - but it’s being sabotaged. Big Pharma doesn’t want generics to win. So they’ve built legal walls around their drugs.

One tactic is “patent thickets.” Instead of one patent, a company files dozens - on packaging, dosing schedules, even inactive ingredients. DrugPatentWatch found that brand-name drugs come with an average of 144 patents at launch. That makes it nearly impossible for generic makers to enter without getting sued. A 2024 JAMA study found that just four drugs blocked by patent thickets cost the system over $3.5 billion in lost savings over two years.

Another trick? “Pay-for-delay.” That’s when a brand-name company pays a generic maker to stay off the market. In exchange for cash, the generic company agrees not to sell its cheaper version for years. Blue Cross Blue Shield estimates these deals cost the system $12 billion a year - $3 billion of it paid by federal programs. The FTC has tried to stop this, but courts keep letting it slide.

Then there’s “product hopping.” A company slightly reformulates a drug - say, changing it from a pill to a capsule - and then pushes doctors to switch patients. Once they do, the original patent expires, but the new version gets a fresh 20-year clock. The FDA has called this practice “gaming the system.” Congress has tried to ban it. So far, they haven’t.

Even when generics do enter the market, administrative barriers get in the way. Prior authorization requirements for generics jumped 47% between 2019 and 2023. That means your doctor has to jump through hoops just to get you a $4 pill. In California, mandatory substitution laws cut that red tape - and drove generic use to 98%. In Texas, where doctors can choose, it’s only 87%.

What’s Next - And Why It Matters

The FDA approved 1,145 generic drugs in 2024 - a 7.3% increase from the year before. Another $24 billion in drug spending is waiting for generic approval by 2025. These aren’t just simple pills. They’re complex injectables, inhalers, and even treatments for rare diseases. That’s where the next wave of savings will come from.

But there’s a threat. Generic manufacturing is becoming more concentrated. Ten companies now control 63% of the market - up from 51% in 2015. That means less competition. And when competition drops, prices rise. The FDA is tracking 287 generic drug shortages as of December 2024. Many are tied to manufacturing problems in India and China. One factory shutdown can leave millions without their medication.

Legislation like S.1041 - the Affordable Prescriptions for Patients Act - could fix some of this. Passed by the Senate HELP Committee in June 2024, it targets patent abuse and pay-for-delay deals. The Congressional Budget Office says it could save $7.2 billion a year. But it’s still stuck in the House.

Meanwhile, the IQVIA Institute projects that if current trends hold, generics and biosimilars will save $5.1 trillion between 2025 and 2034. That’s more than the entire U.S. healthcare budget in 2023. But that projection assumes we fix the broken parts of the system. We won’t get there if we keep letting patent games, PBMs, and bureaucratic delays stand in the way.

What You Can Do

If you’re on a prescription, ask your doctor or pharmacist: “Is there a generic?” Don’t assume your plan automatically picks the cheapest option. Ask if your plan has a formulary - and whether your drug is listed as preferred. If it’s not, ask why. Sometimes, switching to a generic means switching to a different plan during open enrollment.

Use tools like GoodRx or SingleCare to compare prices. A generic that costs $15 at your local pharmacy might be $4 at Walmart or Costco. Some pharmacies even offer $4 generic lists for common medications.

And if you’re frustrated by high prices, speak up. Call your representative. Support policies that end pay-for-delay and patent thickets. Generics aren’t just cheap drugs. They’re the reason millions can afford to stay alive.

Are generic drugs really as effective as brand-name drugs?

Yes. The FDA requires generics to meet the same strict standards as brand-name drugs. They must have the same active ingredient, strength, dosage form, and bioequivalence - meaning they work the same way in your body. Studies show generics are just as safe and effective. Some patients report differences, but those are usually due to inactive ingredients or psychological expectations, not the drug’s performance.

Why do some insurance plans push brand-name drugs over generics?

Some Pharmacy Benefit Managers (PBMs) earn rebates from brand-name drugmakers based on how many of their drugs are prescribed. Even if a cheaper generic exists, the PBM may get paid more to promote the brand. This creates a financial incentive to keep patients on expensive drugs. It’s not always the plan’s fault - it’s how the system is structured.

How much can I save by switching to a generic?

On average, patients save about 80% by switching from brand to generic. For example, the brand drug Lipitor cost over $200 a month before generics. Today, atorvastatin (the generic) costs as little as $4 for a 30-day supply. For people taking multiple prescriptions, switching can save $100-$200 a month - or over $2,000 a year.

What’s the difference between a generic and a biosimilar?

Generics are exact copies of small-molecule drugs, like pills for blood pressure or cholesterol. Biosimilars are similar, but not identical, copies of complex biologic drugs - like injectables for arthritis or cancer. Because biologics are made from living cells, they can’t be copied exactly. Biosimilars must prove they work the same way, but the approval process is longer and more complex. Still, they’ve saved over $56 billion since 2015.

Why are generic drug shortages happening?

Most generic drugs are made overseas, especially in India and China. When a factory has quality issues, supply chains break. Consolidation in the industry - where just 10 companies make 63% of generics - means fewer backup suppliers. The FDA tracks 287 generic shortages as of December 2024. Many are for critical medications like antibiotics, insulin, and heart drugs.

Stephanie Bodde

December 6, 2025 AT 07:31OMG this is so important 😭 I switched my mom to generic lisinopril last year and she’s been saving $120/month-she cries every time she sees the receipt. People don’t realize how much this literally keeps folks alive.

Philip Kristy Wijaya

December 6, 2025 AT 13:16Let me be clear about this because no one else will dare to say it the truth is that generics are a government engineered deception designed to weaken pharmaceutical innovation and hand control to foreign manufacturers in China and India who produce substandard products under the guise of cost savings

William Chin

December 6, 2025 AT 14:09The data presented is statistically valid but the underlying assumption-that market competition alone drives down prices-is dangerously oversimplified. The FDA’s bioequivalence standards are not rigorous enough to account for inter-patient variability in absorption kinetics and the lack of longitudinal safety data for many generics raises legitimate clinical concerns. This is not anti-generic sentiment-it is evidence-based pharmacovigilance.

Ada Maklagina

December 6, 2025 AT 20:24My grandma takes four generics and pays $3 a month for all of them. Walmart is a miracle.

Katie Allan

December 7, 2025 AT 17:50What strikes me most is how this story reveals the hidden architecture of care. The real hero here isn’t the pill-it’s the legal framework that dared to break monopolies. Hatch-Waxman didn’t just change drug pricing; it redefined what public health can look like when policy serves people instead of profits. We need more of this kind of courage in legislation.

James Moore

December 9, 2025 AT 16:14And yet… and yet… the fact remains that the American taxpayer is subsidizing the entire global supply chain for generics-while Chinese factories are quietly hoarding active pharmaceutical ingredients and Indian plants are cutting corners to meet demand-and somehow we’re supposed to celebrate this as ‘progress’? We’ve outsourced our health to foreign regimes with zero accountability-and now we’re being told to be grateful for the crumbs? This isn’t saving money-it’s gambling with lives.

Chris Brown

December 10, 2025 AT 01:54It is morally indefensible that a system which allows for pay-for-delay agreements to persist-while simultaneously permitting pharmacy benefit managers to profit from brand-name promotion-is not classified as criminal fraud. The fact that this continues under the banner of ‘free market’ is a grotesque perversion of capitalism. We are not consumers-we are patients. And patients deserve dignity, not corporate arithmetic.

Stephanie Fiero

December 12, 2025 AT 01:37wait so u mean to tell me i couldve been saving hundreds a month for years?? why did no one tell me this?? i thought generics were like knockoff handbags 😭 i switched my blood pressure med and now i can afford my cat’s insulin. thank u for this post. also typo: ‘dyes’ not ‘dyes’ lol

Laura Saye

December 13, 2025 AT 10:43The structural inequities embedded in PBM rebate models represent a profound misalignment between clinical outcomes and financial incentives. The pharmacoeconomic burden of non-adherence due to cost-related barriers is exponentially greater than the marginal savings achieved through brand promotion. Furthermore, the concentration of manufacturing in two geopolitical regions introduces systemic vulnerability-what we perceive as cost efficiency is, in fact, a latent risk architecture. The ethical imperative is not merely to expand access, but to de-risk the supply chain through diversified, domestically regulated production capacity.