Cost Sharing Explained: Deductibles, Copays, and Coinsurance for Your Health Plan

Dec, 18 2025

Dec, 18 2025

Imagine you need a prescription for a chronic condition. You walk into the pharmacy, hand over your insurance card, and the pharmacist says, "That’ll be $75." You’re confused - your plan says it covers medications, so why are you paying this much? The answer lies in cost sharing - the part of your healthcare bill you pay out of pocket. It’s not just one number. It’s a mix of deductibles, copays, and coinsurance. And if you don’t understand them, you could end up with bills you didn’t expect.

What Is Cost Sharing, Really?

Cost sharing is how you and your insurance company split the cost of care. Your plan doesn’t pay everything. You pay a portion. That’s by design. The idea is to keep monthly premiums lower by having you take on some of the cost when you use services. But it’s not random. There are three main pieces: deductibles, copays, and coinsurance. Each works differently, and they all add up to your total out-of-pocket spending.Let’s be clear: premiums - the monthly fee you pay just to have coverage - are not part of cost sharing. Neither are charges for services your plan doesn’t cover at all. Cost sharing only applies to services your plan actually covers.

Deductibles: The First Hurdle

Your deductible is the amount you pay each year before your insurance starts helping. Think of it like a bucket. You fill it with your own money until it’s full. Only then does your plan kick in.For example, if your deductible is $1,500, you pay 100% of covered medical and pharmacy costs until you’ve spent that much. That includes doctor visits, lab tests, and prescriptions. Once you hit $1,500, your coinsurance kicks in.

Not all services require you to meet the deductible first. Under the Affordable Care Act, preventive care - like annual check-ups, flu shots, or cancer screenings - must be covered at 100% even before you meet your deductible. That’s a big win.

High-deductible health plans (HDHPs) are common now. In 2023, the average individual deductible for these plans was around $7,000. They come with lower monthly premiums, but you pay more upfront if you get sick. HDHPs often pair with Health Savings Accounts (HSAs), which let you save pre-tax money for medical costs. But here’s the catch: you can’t use HSA funds until you’ve met your deductible.

Copays: Fixed Fees at the Point of Care

A copay is a flat fee you pay when you get a service. It’s usually paid at the time of the visit - no waiting, no bill later. Copays are common for doctor visits, specialist appointments, and prescriptions.For instance, your plan might charge $30 for a primary care visit, $50 for a specialist, and $15 for a generic drug. That’s your copay. You pay it whether your deductible is met or not. In many plans, copays for prescriptions apply even before you hit your deductible.

But here’s where it gets tricky: not all plans use copays. Some only use coinsurance. Others use both - copays for visits, coinsurance for hospital stays. Always check your plan’s Summary of Benefits and Coverage (SBC). It’s a short document your insurer is required to give you. It shows real examples of how much you’d pay for common services.

Coinsurance: The Percentage Game

Coinsurance is your share of the cost after you’ve met your deductible. It’s a percentage, not a fixed amount. If your coinsurance is 20%, you pay 20% of the cost of a covered service. Your plan pays the other 80%.Let’s say you need an MRI that costs $850. Your plan has an 80/20 coinsurance split. After you’ve paid your $1,500 deductible, you owe 20% of $850 - that’s $170. Your plan pays $680.

Coinsurance applies to most services: hospital stays, surgeries, lab work, specialty medications. The percentage can vary by service type. Some plans have lower coinsurance for in-network providers and higher for out-of-network. Going out of network can double your share - sometimes even more.

Out-of-Pocket Maximum: Your Safety Net

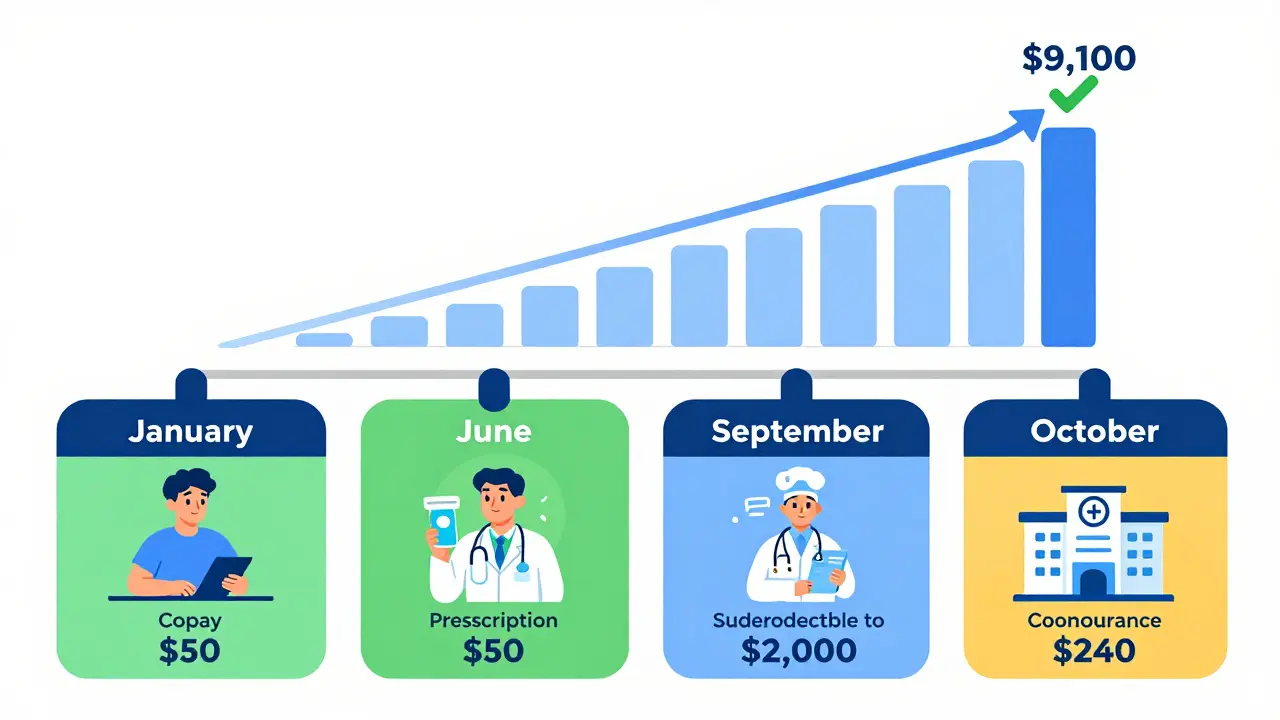

This is the most important number you need to know. It’s the most you’ll pay in a year for covered services. Once you hit it, your insurance pays 100% of everything else for the rest of the year.In 2023, the federal cap was $9,100 for individuals and $18,200 for families. These limits include your deductible, copays, and coinsurance - everything you pay out of pocket for covered care.

But premiums? They don’t count. Neither do out-of-network charges if your plan doesn’t cover them. That’s why it’s critical to use in-network providers. Out-of-network care often has higher coinsurance and doesn’t count toward your out-of-pocket maximum - meaning you could pay way more than you expect.

How These Pieces Work Together

Here’s how it all fits together in a real scenario:- You have a $2,000 deductible, 20% coinsurance, and a $50 copay for prescriptions.

- January: You visit your doctor for a sore throat. Copay: $50. You haven’t met your deductible, so this $50 goes toward it.

- March: You need a blood test. Cost: $300. You pay $300 - your deductible is now at $550.

- June: You get a prescription for a chronic condition. Copay: $50. Deductible now at $600.

- September: You have a minor surgery. Cost: $5,000. You’ve paid $600 so far. You pay $1,400 more to meet your $2,000 deductible. That’s $2,000 total paid.

- October: You need physical therapy. Cost: $1,200. Coinsurance kicks in. You pay 20% = $240. Your plan pays $960.

- November: You have another therapy session. Cost: $1,000. You pay $200 (20%). Your total out-of-pocket so far: $2,000 + $240 + $200 = $2,440.

- December: You hit your out-of-pocket max of $9,100. Everything else for the year? Covered 100%.

That’s the full cycle. It’s not complicated - it’s just layered.

Why People Get Surprised (And How to Avoid It)

A 2022 survey by Healthcare.gov found that 68% of people didn’t understand how their out-of-pocket maximum worked. Many thought it included their monthly premiums. It doesn’t.Another common mistake: assuming your copay is your total cost. If you have a $50 copay for a specialist, but your plan doesn’t cover the test the doctor orders, you pay the full price for that test - and it counts toward your deductible. That’s how surprise bills happen.

Here’s how to avoid them:

- Always ask: "Is this service covered?" and "Will this provider be in-network?"

- Use your insurer’s online cost estimator. People who do this save an average of 22% on out-of-pocket costs.

- Review your SBC every year during open enrollment. It’s not just fine print - it’s your roadmap.

- If you take regular prescriptions, check if they’re on your plan’s formulary and what tier they’re in. Higher tiers mean higher coinsurance.

Medication costs are especially tricky. Some plans have separate drug deductibles. Others apply pharmacy costs to your medical deductible. And with insulin capped at $35/month for Medicare users since 2023, knowing your plan’s rules can save hundreds.

What’s Changing in 2025?

The Inflation Reduction Act extended premium subsidies through 2025, so more people will qualify for lower monthly costs. But deductibles? They’re still rising. In 2022, the average deductible for employer plans was $1,945 - up 66% since 2010.More plans are moving toward "value-based insurance design." That means lower cost sharing for high-value services - like managing diabetes or heart disease - and higher cost sharing for low-value ones, like unnecessary imaging. The goal? Better health outcomes and smarter spending.

Also, the No Surprises Act (2022) protects you from surprise bills for emergency care or if you’re treated at an in-network hospital by an out-of-network provider. That’s huge. But it doesn’t cover everything. You still need to verify your provider’s network status.

Bottom Line: Know Your Plan Like Your Phone Password

You wouldn’t use a phone without knowing the passcode. Don’t use health insurance without knowing your cost-sharing rules. Deductibles, copays, and coinsurance aren’t just jargon - they’re your financial roadmap. Understand them, and you avoid nasty surprises. Ignore them, and you risk paying more than you should.Check your SBC. Call your insurer if something’s unclear. Use their cost tools. Ask questions before you get care. The system isn’t perfect - but you don’t have to be blindsided by it.

What’s the difference between a deductible and a copay?

A deductible is the total amount you pay each year before your insurance starts sharing costs. A copay is a fixed fee you pay at the time of service - like $30 for a doctor visit - and it often counts toward your deductible. You pay copays even before meeting your deductible, but you only pay coinsurance after you’ve met it.

Do copays count toward my out-of-pocket maximum?

Yes. Copays, coinsurance, and the money you pay toward your deductible all count toward your out-of-pocket maximum. Once you hit that limit, your insurance pays 100% of covered services for the rest of the year.

Why is my coinsurance so high for certain medications?

Insurers put drugs into tiers. Generic drugs are usually Tier 1 with low coinsurance. Brand-name or specialty drugs are Tier 3 or 4, with higher coinsurance - sometimes 30% to 50%. This encourages use of lower-cost alternatives. Check your plan’s formulary to see where your meds fall.

Can I avoid paying my deductible if I only see my doctor once a year?

No. If you haven’t met your deductible by the end of the year, you still owe it - even if you didn’t use much care. The deductible resets every January. But preventive services like annual check-ups are covered at 100% regardless of your deductible, so you won’t pay anything for those.

What happens if I go to an out-of-network provider?

You’ll likely pay more. Your coinsurance rate may be higher - sometimes 50% instead of 20%. And in many plans, out-of-network spending doesn’t count toward your out-of-pocket maximum. Always confirm a provider is in-network before scheduling non-emergency care.

Are there services I never pay for, even with cost sharing?

Yes. Preventive services like flu shots, cancer screenings, and annual wellness visits are covered at 100% under the Affordable Care Act - even before you meet your deductible. But only if you use an in-network provider.

Meenakshi Jaiswal

December 19, 2025 AT 22:42Just wanted to say this is one of the clearest explanations I’ve ever read on cost sharing. I’ve been confused for years, especially with how copays and deductibles interact. This breakdown with the timeline example? Game changer. Thank you.

Especially loved the part about preventive care being 100% covered - so many people don’t realize they’re already getting free value just by showing up for their annual checkup.

Monte Pareek

December 20, 2025 AT 21:12Look I get it you’re trying to help but let’s be real - no one reads the SBC. No one. I’ve been in the system for 15 years and I still have to call my insurer every time I need a test because the website is a maze made of legalese and tiny fonts.

And don’t even get me started on how they change the formulary without telling you. I had my insulin jump from Tier 1 to Tier 3 last year and my monthly bill went from $15 to $180 overnight. No warning. No email. Just a surprise bill and a robot voice on the phone saying ‘we’re sorry for the inconvenience.’

Stop pretending transparency is a feature when it’s clearly an afterthought. The system is broken. We need real reform not just better infographics.

Also - yes copays count toward your OOP max. But only if you’re in network. Out of network? You’re on your own. Always confirm. Always.

And if you’re on an HDHP with an HSA? Start saving now. Even $20 a paycheck adds up. It’s the only way to survive the deductible hump.

Moses Odumbe

December 21, 2025 AT 20:59Wow this is so well written 😍 I literally printed this out and put it on my fridge next to my grocery list. Deductible = bucket 🪣, coinsurance = percentage 📊, copay = flat fee 💵 - now I get it. My brain finally stopped screaming.

Also why is no one talking about how insane it is that insulin is capped at $35 for Medicare but I’m paying $90 as a private plan user? That’s not a bug, that’s a feature for the insurance companies 😒

Connie Zehner

December 22, 2025 AT 00:58OMG I’m so glad someone finally said this because I’ve been screaming into the void for years. I had to pay $4,200 last year just to get my thyroid meds because my plan decided to move it to specialty tier and I didn’t realize until I got the bill. I cried in the pharmacy. I literally cried. And then I called my mom and she said ‘you should’ve read the SBC’ like that’s easy??

Also why do they make the formularies so secret? Like is it a top secret CIA document??

Also also - I think insurance companies are just trying to bankrupt us. I swear. They want us to give up. I’m not even mad. I’m just… tired.

holly Sinclair

December 23, 2025 AT 19:22It’s fascinating how deeply embedded the concept of cost-sharing is in the ideological architecture of American healthcare - not just as a financial mechanism but as a moral one. The assumption that individuals should bear the burden of their own care reflects a neoliberal framing of health as a commodity rather than a right. We’ve normalized the idea that suffering must be monetized before it can be treated. The deductible isn’t just a number - it’s a gatekeeper. The copay isn’t just a fee - it’s a psychological deterrent. And the out-of-pocket maximum? That’s not a safety net - it’s a ceiling on compassion.

And yet we praise people who ‘understand their plan’ as if that’s a virtue. But what if the system itself is the problem? What if the real failure isn’t our ignorance, but the design that forces us to become financial surgeons just to survive a broken system?

Maybe we should stop asking people to read their SBCs and start asking why the SBC exists in the first place.

Tim Goodfellow

December 25, 2025 AT 04:00Brilliant breakdown - seriously, this should be mandatory reading for every human with a pulse and a health plan. I’ve been telling my mates in the UK this for years - over here we’ve got the NHS so we don’t even *think* about coinsurance. But over in the States? You’re basically playing financial Jenga with your life savings every time you sneeze.

Also - if you’re on an HDHP, treat your HSA like a golden ticket. Contribute the max. Even if you’re broke. Even if you think you’ll never need it. That money grows tax-free. It’s the one loophole in this whole circus that actually works.

And for the love of all things holy - always ask if a test is ‘medically necessary.’ If it’s not, you’re on the hook. No one tells you that. They just hand you the bill later. Classic.

Elaine Douglass

December 27, 2025 AT 00:18thank you so much for writing this i was so confused about the difference between coinsurance and deductible and now i get it like actually get it

also i never knew copays counted toward the max that changed everything for me

youre a lifesaver

Mahammad Muradov

December 27, 2025 AT 15:14People complain about cost-sharing like it’s some new evil invented by Big Pharma. Newsflash - it’s been around since the 1970s. Insurance was never meant to pay for everything. That’s why you have a premium - you’re buying access, not free stuff.

And if you can’t afford your deductible, maybe you shouldn’t have picked a plan with a $7K deductible. You don’t get to blame the system for your poor financial decisions.

Also - if you didn’t read your SBC, that’s not the insurer’s fault. That’s your laziness. Get a grip.

And stop crying about insulin. Medicare is a government program. Private insurance isn’t obligated to match it. That’s not discrimination - that’s capitalism.

Kelly Mulder

December 29, 2025 AT 00:39While I appreciate the effort expended in elucidating the mechanics of cost-sharing, I must insist that the underlying premise remains fundamentally flawed. The notion that individuals ought to navigate a labyrinthine, opaque, and intentionally convoluted system in order to access basic medical care is not merely inefficient - it is morally indefensible.

Moreover, the use of terms such as ‘out-of-pocket maximum’ implies a bounded, rational framework - when in reality, the financial exposure is arbitrary, inconsistently applied, and often weaponized through tiered formularies and network exclusions.

One must wonder: if a patient is required to become a financial analyst to receive a prescription, is healthcare truly a right - or merely a privilege contingent upon literacy, privilege, and patience?

And yet - how dare one suggest that the SBC is unreadable? It is, after all, a document meticulously crafted by legal teams and approved by regulatory bodies. To call it ‘confusing’ is to indict the reader - not the system.

Takeysha Turnquest

December 30, 2025 AT 22:47the deductible is like the universe testing you

you think you’re ready for life

then BAM

you need an MRI

and suddenly you’re staring at a bill that looks like a poem written by a robot with anxiety

and you realize

you were never meant to understand this

you were just supposed to survive it

and somehow

you did

and that’s enough

for now

bhushan telavane

January 1, 2026 AT 05:06in India we don’t have this mess. You pay cash or you don’t go. No insurance, no deductible, no formulary. If you’re rich, you go to a private hospital. If you’re poor, you go to a government clinic. Simple.

But yeah - I see why Americans are confused. This system is like a video game with no manual and 17 hidden levels.

Emily P

January 1, 2026 AT 15:23Can someone explain why out-of-network charges don’t count toward the out-of-pocket maximum? That feels like a trap. Like, if I go to an in-network hospital but the anesthesiologist isn’t in-network, I get hit with a bill that doesn’t help me reach my cap? That’s not fair.

I just want to know if I’m missing something or if this is just how it is.