Combo Generics vs Individual Components: The Real Cost Difference

Jan, 13 2026

Jan, 13 2026

Imagine you’re on two medications - one for blood pressure, another for diabetes. Your doctor hands you a single pill that combines both. It’s convenient. But how much are you really paying for that convenience? In the U.S., many patients are being charged far more for these combo pills than they’d pay if they bought the same ingredients separately as generics. And the difference isn’t small - it’s often hundreds of dollars a month.

Why Combo Pills Cost So Much More

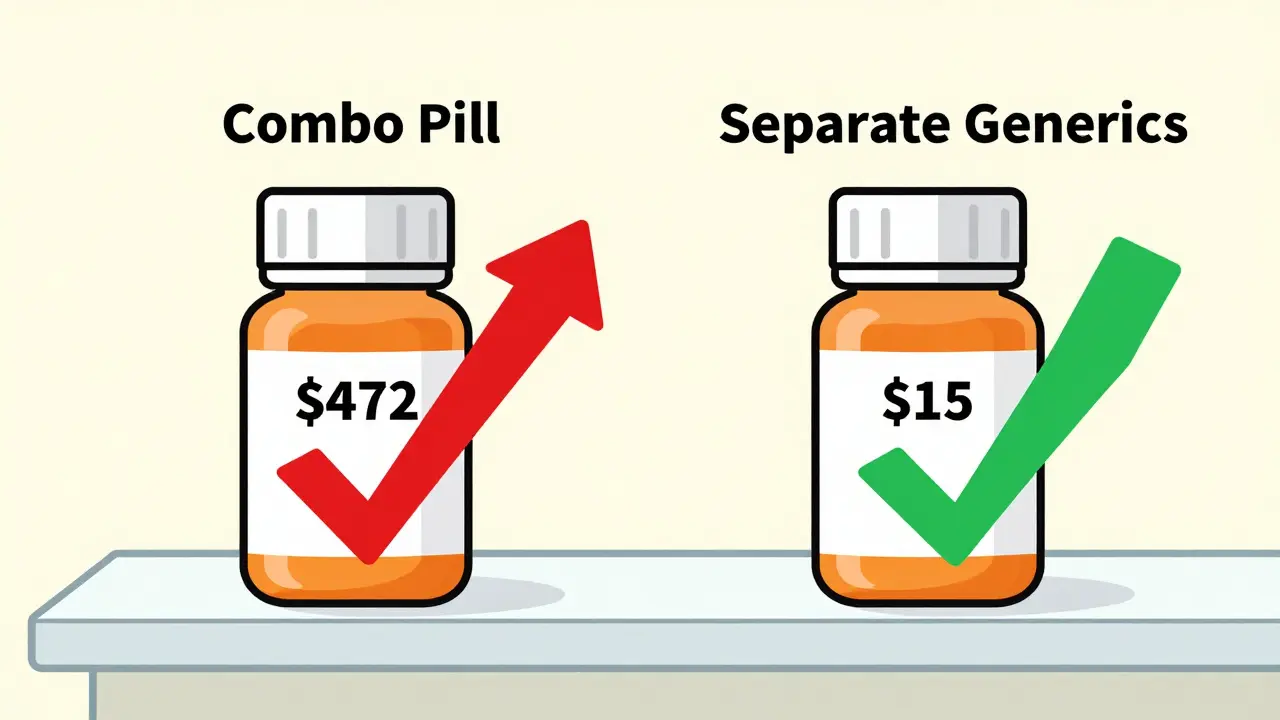

Fixed-dose combinations (FDCs) are pills that pack two or more drugs into one tablet. They sound smart: fewer pills to remember, better adherence. But here’s the catch - when one or both of those drugs are already available as cheap generics, the combo pill often costs 10 to 15 times more than buying them separately. Take Janumet, a combo for type 2 diabetes. It contains sitagliptin and metformin. In 2016, Medicare paid an average of $472 for a 30-day supply of Janumet. Meanwhile, generic metformin? At Walmart’s $4 program, you could get a month’s supply for $4. Even if you paid full price for the brand-name sitagliptin (which was still under patent), you’d be looking at under $100 for both drugs separately. Yet the combo cost nearly five times that. This isn’t an outlier. A 2018 study in JAMA Internal Medicine found that Medicare spent $925 million more in 2016 on 29 branded combo drugs than it would have if doctors had prescribed the individual generic components instead. For the top 10 most expensive combos, the potential savings were $2.7 billion. That’s not a rounding error - that’s enough to cover free prescriptions for millions of seniors.The Math Behind the Markup

Pharmaceutical companies don’t price combos based on the cost of ingredients. They price them based on what the market will bear. IQVIA’s 2022 analysis showed that branded combos typically cost about 60% of what two separate brand-name drugs would cost. That sounds like a discount - until you realize that generic versions of those same drugs cost 80-85% less than the brand names. So if two brand-name pills cost $200 total, the combo might be $120. Sounds fair? But if you can buy the same two drugs as generics for $15 total, that $120 combo is a 700% markup. And in many cases, that’s exactly what’s happening. The trick? One drug in the combo is still under patent. The other is generic. The manufacturer uses the new drug to justify the high price, even though the old one is dirt cheap. This is called “evergreening.” It’s legal. It’s common. And it’s costing taxpayers billions.Real-World Examples That Shock

Here are a few real cases from Medicare data:- Entresto (sacubitril/valsartan): Used for heart failure. Brand combo costs about $550/month. Generic valsartan? Around $10. Sacubitril alone? Still expensive, but not $540 more than the generic.

- Kazano (alogliptin/metformin): Combo price: $425/month. Generic metformin: less than $10. Even if alogliptin cost $100, you’re still overpaying by $300.

- Nexlizet (ezetimibe/bempedoic acid): Ezetimibe has been generic for years. Bempedoic acid is new. The combo costs $12 a day in the U.S. That’s $360 a month. The same amount of ezetimibe alone? $5. You’re paying $355 extra for a new drug - and getting an old one for free.

Why Doctors Still Prescribe Them

You might wonder: if the savings are so obvious, why aren’t doctors just prescribing separate generics? One reason: convenience. Patients with multiple conditions often take 5-10 pills a day. A combo reduces that to 3 or 4. Studies show adherence improves by 15-20% when pill burden is lower. That matters. Missed doses lead to hospitalizations - which cost far more than the drug difference. Another reason: inertia. Many doctors aren’t aware of the cost gap. Pharmacy systems often default to the combo because it’s listed first in the formulary. And patients? They’re told, “This is simpler.” They don’t ask about price. Pharmaceutical reps also push combos harder. They get bigger commissions on new, branded products - even when cheaper alternatives exist.Who’s Winning and Who’s Losing

The winners? Drug manufacturers. Companies like Novartis, Merck, and Bristol Myers Squibb made billions from these combos. Their profits rely on the fact that most patients don’t know they can save money by asking for generics. The losers? Patients. Medicare. Medicaid. Employers. Taxpayers. In 2021, combo drugs made up just 2.1% of prescriptions but accounted for 8.3% of Medicare Part D spending. That’s a massive imbalance. Even worse, Medicare pays 22-33% more for the same brand-name drugs than the VA does. So if you’re on Medicare, you’re paying more than a veteran with the same condition.What’s Being Done About It

There’s growing pressure to fix this. The Inflation Reduction Act of 2022 gave Medicare the power to negotiate drug prices - including combos. That’s a big deal. For the first time, the government can step in and say, “This combo costs too much.” The FDA is also speeding up approval of generic versions of individual components. More generics = more competition = lower prices. And pharmacy benefit managers (PBMs) are starting to block combos from formularies unless there’s a clear clinical reason. Some insurers now require prior authorization for combos. Others have “preferred generic” policies - meaning if you can get the same drugs as separate generics, you’ll pay less. University of Michigan Health System found that switching patients from combos to generics saved an average of $1,200 per patient per year. Novartis even launched an “Entresto Access Program” offering the combo for $10 a month to Medicare patients. Sounds generous? It is - but it’s still $9 more than generic valsartan alone. And it doesn’t fix the system.

What You Can Do

If you’re on a combo drug, here’s what to ask your doctor or pharmacist:- Are both components available as generics?

- What’s the total cost if I buy them separately?

- Is there a clinical reason I need the combo - or is this just convenience?

- Can I try the generics first and see how I feel?

The Bigger Picture

This isn’t just about pills. It’s about how our healthcare system lets companies charge inflated prices under the guise of innovation. Combo drugs are a perfect example: marketed as progress, but often just a way to extend profits. The good news? We’re starting to see change. More people are asking questions. More doctors are checking prices. More insurers are pushing back. If you’re paying hundreds a month for a combo pill - you’re not alone. But you don’t have to keep paying it.Frequently Asked Questions

Are combo pills ever worth the extra cost?

Yes - but only if both drugs are still under patent or if one is brand-new and not available as a generic. For example, if you’re taking a combo with two brand-new drugs, the price might be justified. But if one component has been generic for years - like metformin or valsartan - the combo is almost always overpriced. Always ask if separate generics are an option.

Can I ask my pharmacist to fill two generics in one pill?

Pharmacists can’t legally combine two separate pills into one tablet - that’s manufacturing, which requires FDA approval. But they can give you two separate generics in the same blister pack, labeled together. Many pharmacies now offer this as a “combination packaging” service. It’s not a single pill, but it’s just as easy to take.

Why don’t insurance plans always cover the cheaper generics?

Some plans don’t have the right formulary rules in place. Others are slow to update. Many still default to the combo because it’s listed as the “preferred” option in the drug database. But if you request a generic substitution and it’s medically appropriate, your insurer must approve it under federal law. Call your plan and ask for a formulary exception.

Is this problem only in the U.S.?

No - but it’s worst here. Countries like Germany and the U.K. use pricing models that cap combo costs based on the sum of individual components. In the U.S., there’s no such rule. Drugmakers can set any price they want, as long as it’s not deemed “unreasonable” - and there’s no clear definition of that. That’s why U.S. combo prices are often 5-10 times higher than in other developed countries.

What’s the future of combo drugs?

Combo drugs will keep growing - especially in heart disease and diabetes - because they’re profitable. But as more generics enter the market and Medicare starts negotiating prices, we’ll see more pressure to lower costs. Expect more “preferred generic” policies, prior authorization rules, and patient education campaigns. The goal isn’t to eliminate combos - it’s to stop overcharging for them.

Henry Sy

January 15, 2026 AT 06:33So let me get this straight - we’re paying $500 for a pill that’s just $4 metformin plus some fancy new junk? That’s not healthcare, that’s a casino where the house always wins. I’ve seen my grandma cry over her co-pay. This ain’t innovation, it’s theft with a prescription pad.

says haze

January 16, 2026 AT 09:49The structural inequity here is not merely economic but epistemological: the medical-industrial complex has successfully reified convenience as clinical necessity, thereby obscuring the moral economy of pharmaceutical pricing. The fact that patients are incentivized - through behavioral nudges and formulary defaults - to accept overpriced FDCs reveals a deeper pathology: the commodification of adherence itself. We are not just overpaying for pills; we are paying for the erosion of patient autonomy under the guise of therapeutic efficiency.

Alvin Bregman

January 16, 2026 AT 22:52i mean i get why docs do it, less pills to remember right? but then you find out the combo costs 10x and you feel kinda fooled. my cousin switched to separate generics and saved like 400 a month. same blister pack, same schedule. why dont they just tell people this? its wild

Robert Way

January 17, 2026 AT 18:22so the drug companies just slap two drugs together and charge a fortune? no wonder my insurance keeps denying stuff. i asked my doc about generics and he looked at me like i was asking for a unicorn. dumb

Sarah Triphahn

January 18, 2026 AT 01:30People who don’t question combo pills are part of the problem. You think convenience is worth your life savings? Wake up. This isn’t about choice - it’s about manipulation. If you’re paying over $100 a month for metformin, you’re being played. Stop being passive. Ask for the generics. Fight back.

Vicky Zhang

January 19, 2026 AT 11:31Hey, I know this is heavy but I want you to know - you’re not alone. I used to take Janumet too, and I felt so guilty for not being able to afford it. Then I found out I could get the two pills separate for under $15. My pharmacist even put them in the same blister pack so it felt just like before. I cried. Not from sadness - from relief. You can do this. You deserve to be healthy without being broke. Talk to your pharmacist. Ask. Push. They’re on your side.

Allison Deming

January 19, 2026 AT 19:40It is profoundly troubling that the United States, a nation that prides itself on innovation and medical advancement, has permitted a system in which pharmaceutical manufacturers are permitted to exploit regulatory loopholes and patient ignorance to extract exorbitant profits. The moral failure is not merely financial - it is existential. When a life-saving medication becomes a luxury item, the healthcare system ceases to be a system of care and becomes a system of extraction. This is not capitalism. This is predation.

Susie Deer

January 21, 2026 AT 02:11Other countries cap prices so we're getting screwed. This is why America is falling apart. Drug companies own Congress. You think your vote matters? Wake up. We're being robbed by people who don't even live here. Fix this or get used to paying $500 for a pill that costs $5 to make.

TooAfraid ToSay

January 21, 2026 AT 07:43you think this is bad? wait till you hear what they do in Nigeria with insulin. here you at least have a choice. over there? you pray the shipment comes. so stop complaining. you got generics. you got options. we got nothing. your problem is privilege.

Dylan Livingston

January 22, 2026 AT 05:24Oh, so now it’s our fault for not being ‘smart’ enough to navigate a system designed to confuse us? The fact that a $4 generic is buried under 12 layers of marketing and formulary bureaucracy doesn’t make it a personal failure - it makes it a crime. And don’t give me that ‘ask your pharmacist’ nonsense. Have you seen the wait times? The turnover? The pharmacists are overworked and underpaid. They’re not your personal price detectives. This is systemic corruption - and you’re being gaslit into thinking you’re the problem.

Andrew Freeman

January 22, 2026 AT 06:50they say combo pills help you remember but honestly i forget either way. i just dump all my pills in a box and hope for the best. if the combo costs 10x and does the same thing? no thanks. i switched and saved 300 a month. my dog eats more than my meds now

Sarah -Jane Vincent

January 23, 2026 AT 20:14THIS IS A BIG PHARMA COVER-UP. They’re using combo pills to hide the fact that they’re just repackaging old generics with a new patent on one ingredient. The FDA is in their pocket. Medicare pays more than the VA because the VA has price controls - but you? You’re the cash cow. They’re not just overcharging - they’re running a Ponzi scheme on your health. And the worst part? They’re counting on you to stay silent. Don’t be quiet. File complaints. Call your reps. Post this everywhere. They don’t want you to know this exists - and that’s why it’s still happening.